Important information for customers sending parcels and goods to the United States

As of 29 August 2025, the US President has abolished the duty-free threshold of $800 (known as ‘de minimis’). Previously, this threshold applied to imports into the United States of goods for personal use, as well as any goods purchased abroad from foreign online stores and marketplaces.

Under the new rules, all international shipments imported into the United States will be subject to customs duties and taxes, regardless of their value. This may lead to longer customs clearance times and additional costs for recipients in the United States. The customs duty for goods originating in Ukraine is set at 10%.

What changes in the delivery process can buyers in the United States expect?

From 26 August 2025, when sending via the Nova Post network, the sender will be able to choose who will pay customs duties — the sender or the recipient.

- If the sender is the payer, only 10% of the shipment cost will be added to the delivery cost, and customs clearance services are included in the tariff.

- If the recipient is selected as the payer, they will have to pay 10% of the shipment cost upon receipt, as well as customs brokerage services — from $25 per shipment.

The recipient will receive an email with a link to pay the customs duties and customs brokerage services. The shipment will be delivered after payment. The final amount of customs duties and customs brokerage services will be determined during customs clearance upon delivery to the United States.

Important clarifications

- It is necessary to correctly indicate the country of origin of the goods in the shipment. The 10% duty rate applies only to goods manufactured in Ukraine. Rates may vary for goods from other countries.

- US customs authorities are tightening controls on all imported goods. Particular attention will be paid to:

- the accuracy of the description of the goods,

- the authenticity of the country of origin,

- the conformity of the declared purpose of export,

- the accuracy of the stated market value of the goods.

If any inaccuracies or discrepancies are found, the goods may be detained with the risk of additional charges.

Follow our news and announcements!

Solutions for customers sending parcels via Nova Post LLC branches

At the branch, operators will offer customers to choose who will pay customs duties — ‘Sender’ or ‘Recipient’.

Based on the cost of the shipment, the operator will inform the customer of the amount to be paid by the Sender and the amount to be paid by the Recipient.

Solution for customers using the Nova Post mobile app

Customers who create shipments in the Nova Post mobile app will be notified of changes in US legislation.

They will be able to create MENs using the standard flow, and at the branch they will be asked if they wish to pay customs duties on behalf of the Recipient.

Solution for customers who use the Nova Post personal account

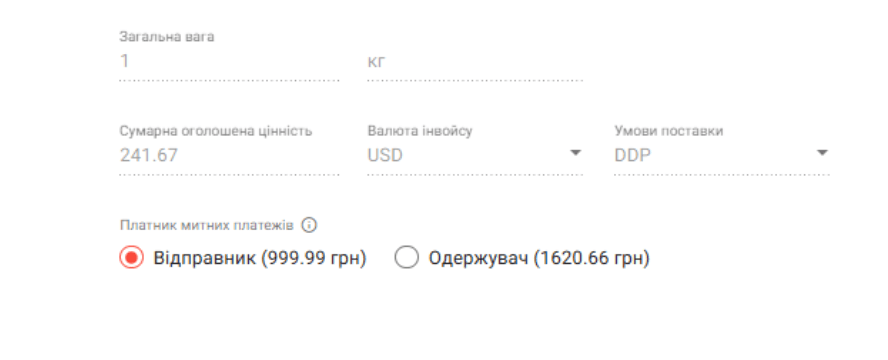

When filling out the invoice, you will be able to select ‘Customs duty payer’: “Recipient” or ‘Sender’.

The corresponding calculations will be displayed in the interface.

Example on the screenshot:

Solution for customers using Nova Post API

For customers using Nova Post API, we have developed a technical solution for selecting the payer of customs duties for the United States.

To do this, you need to change the following in the request:

{

"status": "ReadyToShip",

"clientOrder": "string",

"note": "string",

"payerType": "Sender",

"payerContractNumber": null,

"invoice": {

"incoterm": "DAP" or "DDP"

// DAP — якщо платник податків = Отримувач

// DDP — якщо платник податків = Відправник

}

}